In this value creation series, we examine the key levers for generating sustainable value in private markets. We will explore the full investment cycle, from due diligence and strategy implementation to execution, reporting, and preparing for responsible exits.

This first edition focuses on sustainability due diligence, highlighting how a robust approach goes beyond checklists to uncover value creation opportunities, align with investment strategies, and ultimately enhance enterprise value.

4 min read

Summary

- Investors continue to recognise sustainability as a driver of value creation. What remains unclear is their understanding of the embedded ESG risks and opportunities.

- General Partners (GPs) that treat sustainability due diligence as a box-ticking exercise risk missing out on meaningful value creation opportunities.

- A robust sustainability due diligence methodology enables better integration with traditional risk management and aligns more closely with investment strategies.

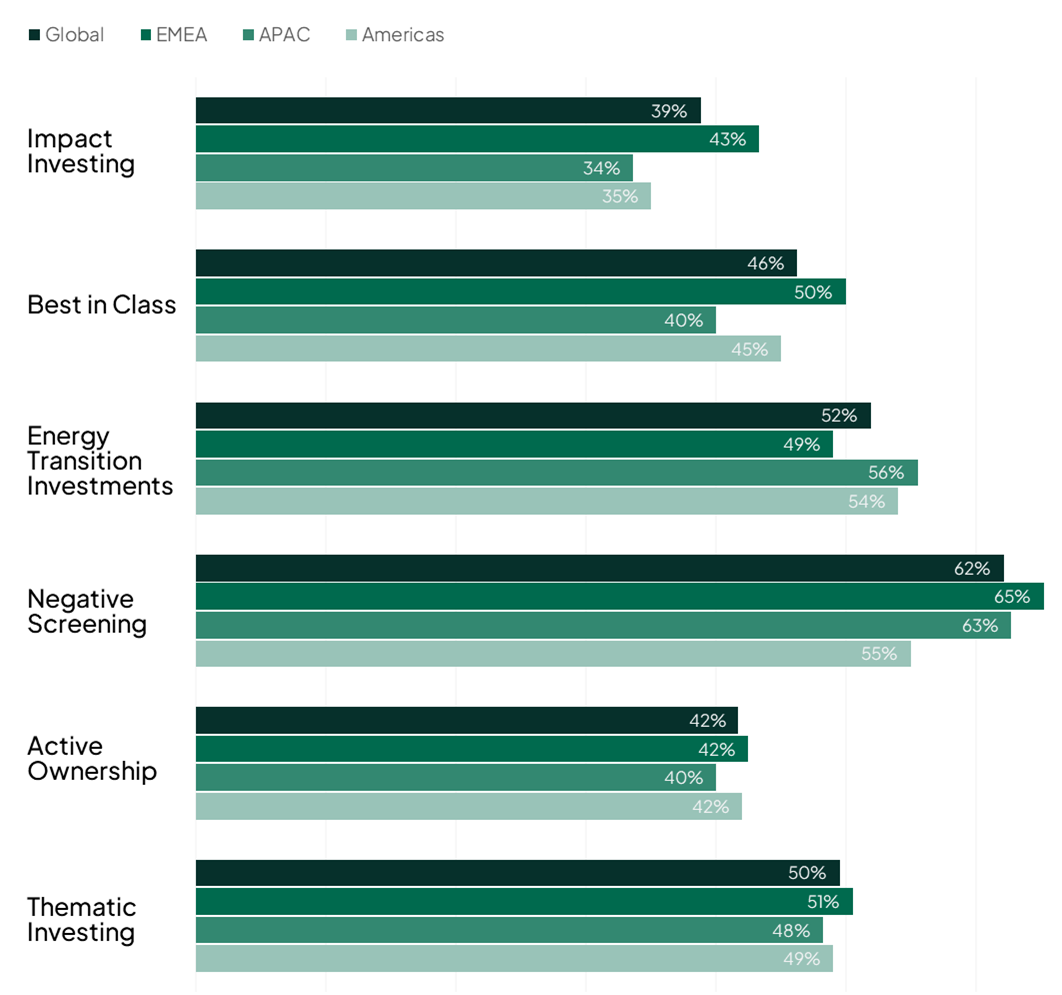

As sustainability gains traction as a critical lever for value creation, investors are increasingly incorporating environmental, social, and governance (ESG) factors into their decision-making. Yet, understanding the full scope of ESG risks and opportunities remains foundational. Without this insight, even the most well-intentioned integration efforts may fall short. According to the BNP Paribas 2025 ESG Global Survey, 68% of investors have incorporated ESG into their investment processes to some extent (see exhibit 1).

Exhibit 1

ESG Integration Approaches used by Investors by Region in 2024

source: BNP Paribas ESG Survey 2025; Advian Partners Insights

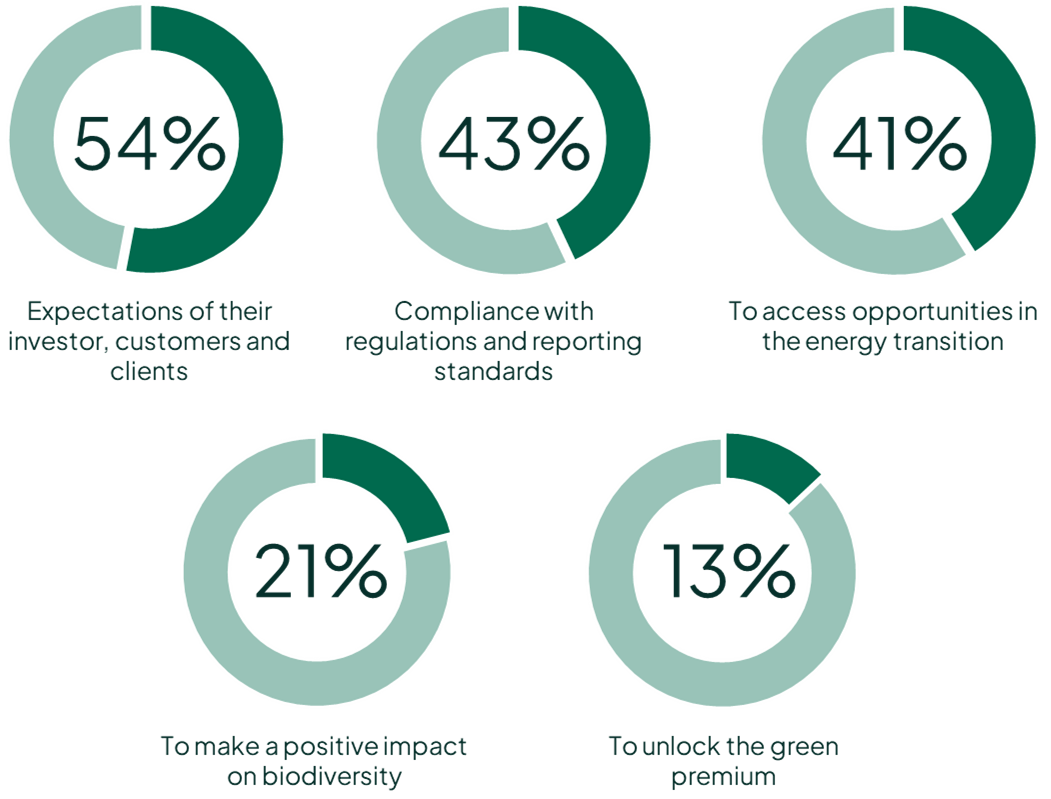

For private capital managers, ESG integration is often driven by several key factors; investor and client expectations, the pursuit of a “green premium,” access to opportunities in the energy transition, biodiversity impact, and regulatory compliance (see exhibit 2).

A strategic question lies beyond compliance and market expectations; How can sustainability be used as a true engine of value creation? By our assessment, this starts with a comprehensive due diligence process. A process that involves going beyond surface-level assessments, starting by uncovering ESG Risks in the value chain of a target company to mapping out the ESG value drivers. We highlight some examples:

- How does a target company’s energy efficiency measures impact operational costs and margins?

- What is the revenue impact of effective talent management and employee retention systems?

These are the kinds of insights a rigorous sustainability due diligence process could deliver.

Exhibit 2

Share of Private Capital Managers Integrating ESG by their Reason of Importance

source: BNP Paribas ESG Survey 2025; Advian Partners Insights

The Pitfalls of a Check-Box Approach

ESG due diligence is often restrained to a tick-box exercise to determine whether basic systems are in place to manage environmental, social, and governance risks. The task is seen as a compliance one or a reputational one without much influence to enterprise value.

Conventional ESG assessments typically evaluate:

- Environmental factors: greenhouse gas (GHG) emissions, pollution, waste, water use, biodiversity, etc.

- Social factors: labour practices, human rights, community relations, etc.

- Governance factors: corporate governance, ESG policies, business ethics, etc.

Too often, these areas are reviewed in isolation, without linking them to financial materiality. A more impactful approach seeks to connect the dots between sustainability practices, ESG risk exposure, and financial outcomes, turning ESG insights into actionable levers for post-investment value creation.

The Case for a Robust Sustainability Due Diligence Methodology

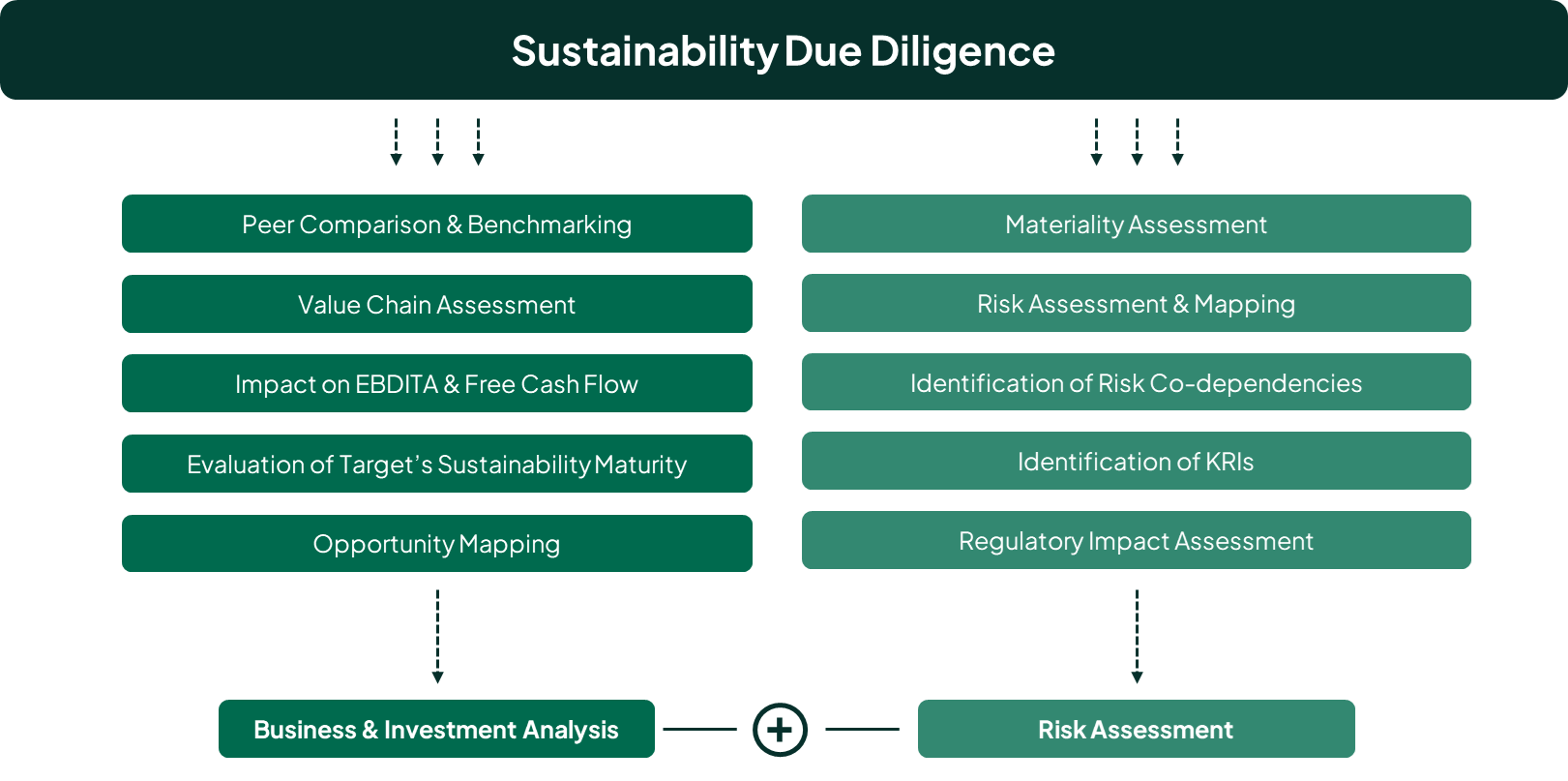

A comprehensive sustainability due diligence process enables investors to assess not only ESG risks but also how ESG performance aligns with the fund’s investment thesis. By applying a methodology that merges ESG analysis with business and financial fundamentals, actionable insights can be used to enhance strategic decision-making throughout the investment cycles of the target company (see exhibit 3).

Exhibit 3

A Snapshot of Advian Partners’ Approach to Sustainability Due Diligence

source: Advian Partners Insights

A robust approach typically includes:

- Peer benchmarking and ESG maturity comparisons

- Value chain analysis to assess upstream and downstream ESG risks

- Materiality and double materiality assessments

- ESG risk mapping and identification of Key Risk Indicators (KRIs)

- Regulatory and compliance impact reviews

- Evaluation of impacts on EBITDA and Free Cash Flow

Recognising that no two companies are alike, we tailor our sustainability due diligence frameworks based on value chain insights and strategic goals. This ensures alignment with your investment philosophy and creates a clear roadmap for value creation throughout the investment lifecycle

Partner with Advian

At Advian Partners, we help investors uncover the hidden risks and opportunities embedded within ESG performance on the entity and portfolio level. Our tailored due diligence frameworks provide the foundation for investment strategies that go beyond compliance; enabling real, measurable value creation at exit.

For more information contact us here or email us: contact@advianpartners.com